Welcome to Deleon Trade LLC, your partner in customs compliance consulting. Explore our cutting-edge expertise and strategic guidance to ensure your business excels in compliance.

Meet the Team

Pictured above is the Deleon Trade Team at the 2025 Advanced Topics in Customs Compliance Conference in Houston, TX.

First row: Paulie Nichols, Guillermo Deleon, Cindy Deleon, Kathryn Herrity, Rosa Fuentes, Jeff Sanford

Second row: John Metrich, Ashley Adducci, Kristin Simonson, Kristina Carter, Melissa Shanahan

Our team is comprised of highly trained and experienced trade auditors (all possessing bachelor’s degrees in accounting) and Licensed Customs Brokers with extensive training and decades of experience.

As your dedicated customs compliance consultant, we are committed to providing tailored solutions, strategic guidance, and cutting-edge expertise to propel your business towards compliance excellence.

We encourage you to leverage our curated Forced Labor resources and to learn more about our services to help businesses take proactive steps towards ensuring ethical sourcing practices.

Explore the trade resources hub curated by Deleon Trade LLC. Stay informed, compliant, and ahead of the curve with the knowledge and tools needed for customs compliance excellence.

Follow us on LinkedIn!

Click the Follow button on LinkedIn to receive informative and up-to-date insights on important trade topics in your newsfeed.

Click the bell icon to receive notifications of new posts!

*NEW*

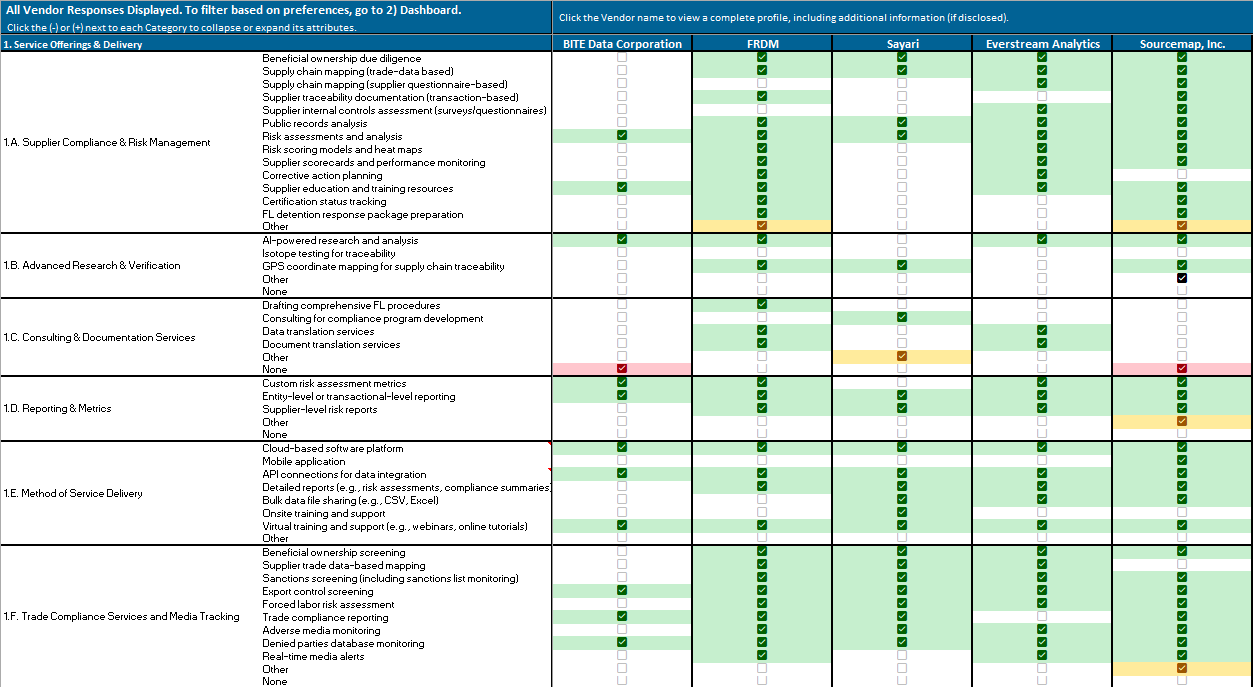

Deleon Trade's Software Vendor Matrix

Our goal is to empower the trade community by providing a comprehensive tool that aids in identifying suitable software solutions to address high-risk compliance challenges, including forced labor and other critical areas.

By facilitating informed decision-making, we aim to help organizations achieve an improved state of compliance and strengthen their overall approach to ethical and legal trade practices.

Our new tool has been expanded and modernized to include 100+ tracked attributes heavily focused on: Applicability & Capabilities (Forced Labor and beyond!), Service Offerings & Delivery, and Data & Security.

ATCC 2026

The Advanced Topics in Customs Compliance Conference (ATCC) is a premier customs compliance industry conference focused on complex, high risk, or hot button trade topics.

Join compliance professionals and peers at the annual ATCC Conference featuring top-rated speakers and panelists. In addition, benefit from:

- Superb networking opportunities

- Ability to benchmark against some of the industry's best

- Unwind with live music, dancing, drinks, food & prizes after intense educational sessions

- Continuing education certificate awarded after completion of conference, subject to attendance verification

February

4-6 2026

Omni

Houston

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.